Coinshares found that new investors primate into the Bitcoin market, at each division. Hence, establishing the groundwork for another bull cycle. As its cost develops during the bull cycles, the coin acquires ubiquity prompting more speculations.

Long-term investors holding Bitcoin [BTC] are quicker on clutching their BTCs as opposed to spending them, even despite rising costs, another report from CoinShares uncovered.

As indicated by its new report, Coinshares speculated that when BTC investors go through a full cycle top and enter a bear market, they cease from selling their coins underneath the price tag.

By clutching their coins, they confine supply which, as per Coinshares, makes a “disadvantage support… during the cost slump, until at long last finding benefits in the following rise where many beginning selling.”

At the point when these investors, at last, make money, their prosperity empowers another age of long-term holders who are brought into the Bitcoin market and afterward go through similar cycle as their ancestors.

Long-term investors holding Bitcoin [BTC] are quicker on clutching their BTCs as opposed to spending them, even notwithstanding rising costs, another report from CoinShares uncovered.

In a formerly distributed report, Coinshares found that new investors chimp into the Bitcoin market, at each splitting. In this manner, establishing a groundwork for another bull cycle. As its cost develops during the bull cycles, the coin acquires prevalence prompting more speculations.

As indicated by its new report, Coinshares conjectured that when BTC investors go through a full cycle top and enter a bear market, they cease from selling their coins underneath the price tag.

By clutching their coins, they limit supply which, as per Coinshares, makes a “disadvantage support… during the cost slump, until at long last finding benefits in the following rise where many beginning selling.”

At the point when these investors at last make money, their prosperity supports another age of long-term holders who are brought into the Bitcoin market and afterward go through similar cycle as their ancestors.

Like your dads before you

As expressed above, new investors gorilla into the BTC market at each dividing. Following the first dividing event in 2012, BTC was bought by new participants into the market toward the start, and toward the finish of 2013 stayed inactive for a considerable length of time.

This “hodling” by these long-term investors prompted a limitation in the supply of the lord coin. That, combined with the dividing event in 2016, added to the quick value growth of BTC in 2017. At the point when these investors made money, new investors were brought into the market in 2017.

CoinShares found that investors who purchased BTC in 2016 and 2017 keep on holding as these coins lay inactive in their addresses.

As per the report, this classification of investors liked to hold their resources instead of sell even over their securing cost. In such manner, CoinShares expressed,

“We now see the same pattern, having taken its course for coins exchanged at lofty bitcoin prices in 2017, where a new era of investors has chosen to resist the urge to sell their coins despite having the opportunity to realize profits at any time in 2021. This provides some explanatory power to the increase in bitcoin price following the 2020 halving when available bitcoin supply was again constrained, while also suggesting the 2017 class of bitcoin investors carry a similar conviction to those initiated in 2013.”

Likewise, CoinShares tracked down that the class of long-term investors that entered the market in 2017 “appear to be accumulating their coins considerably more forcefully than we’ve found in past cycles.”

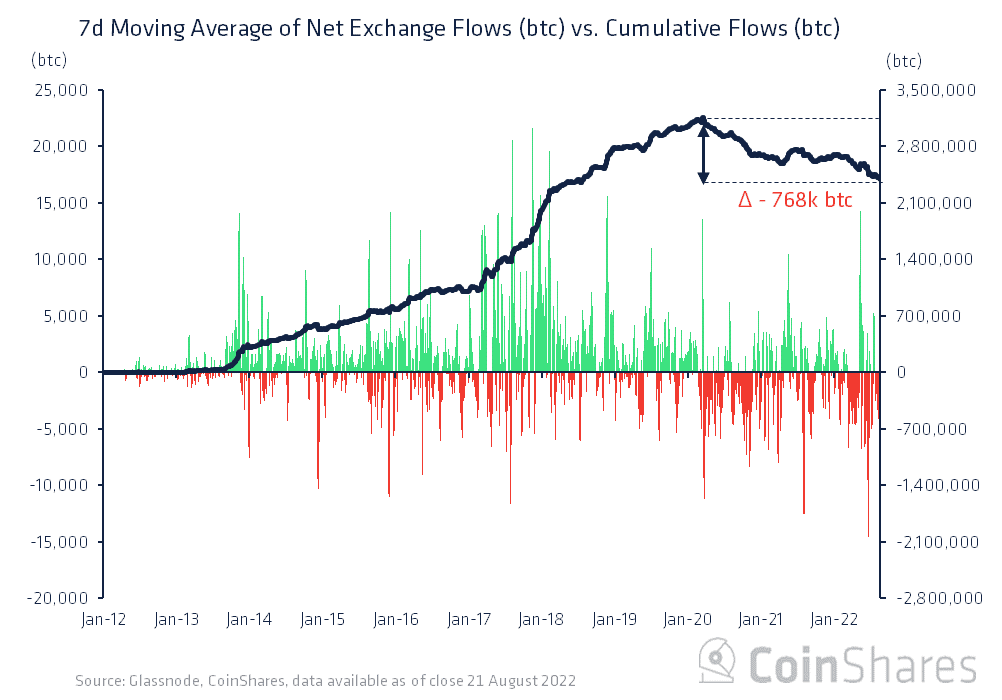

As per the report, while certain investors sent their BTC to trades to create gains during the 2021 convention, the outpourings from trades have surpassed inflows starting around 2022. In this manner, demonstrates that the 2017 long-term-purchasers stay enduring in holding.