The SEC and those who make crypto should work together to find a middle ground. When developers, investors, and regulators work together, they can come up with best practices and improve the quality of cryptocurrency development.

Regulators need to find a way to protect consumers while also making it possible for entrepreneurs and the private sector to do well. Regulation can be a big help when markets aren’t working right, maybe because of an externality or a lack of information.

But regulations can also make it hard for people to start their own businesses, which hurts society and its people. The US Securities and Exchange Commission has been very mean to cryptocurrency companies and entrepreneurs. SEC Chairman Gary Gensler has said that he thinks of Bitcoin (BTC) as a commodity, but that many other “crypto financial assets have the key characteristics of a security.”

In an explosive opinion piece for The Wall Street Journal on August 19, he said the same thing. He argued that “you could replace “crypto” with any other asset” when talking about how securities are regulated.

But instead of “regulating by op-eds,” as some crypto fans have said, it would be better for developers, investors, and regulatory agencies like the SEC to work together at least around common standards that can raise the quality of projects overall and set best practises that the whole Web3 community will benefit from.

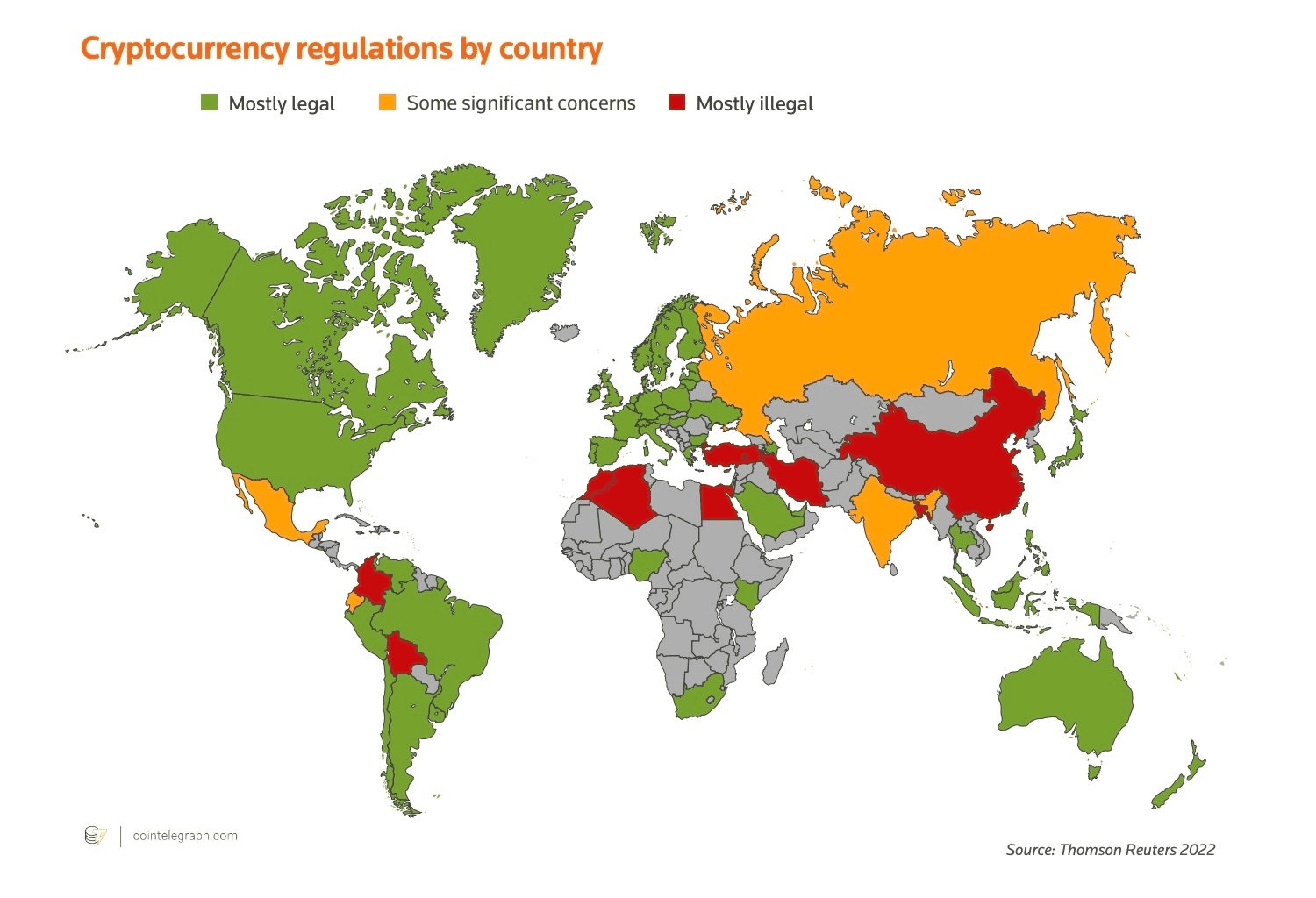

Defining Laws in Various Countries

The famous Howey Test, which is based on a 1946 Supreme Court case that established a standard for what a security is, is mentioned in almost every article about crypto regulation. But Gensler has focused on what may be the most important of the criteria, which is that “the investing public is hoping for a return.”

Many nonfungible token (NFT) projects launch up, and their founders promise investors big returns that turn out to be clearly false or at least exaggerated. But the problem with these projects isn’t that NFTs need to be labelled as securities. The problem is that the founders are not being honest with their marketing and are making promises they can’t keep.

The Howey Test says that there is a “investment contract” if there is (1) an investment of money, (2) in a common business, (3) with the expectation of profit, and (4) for the profit to come from the work of others. But what if someone used the Howey Test to look at a house? A household could be thought of as a business, especially if there is a family business, and every homeowner invests with the hope that their house price will go up.

One reason why this is wrong is that a household is too small to be a common business. But where do you draw the line? What if your family is big? Or, what if the immediate family doesn’t have enough money and other family members help pay for the house? Or, what if a group of people decides to rent a larger house so they can spend some time there and also rent it out on Airbnb while they travel and spend time in other places? The problem with the Howey Test is that it was made for a much more specific and narrow situation, one that involved renting to farmers.

There isn’t a clear line between securities and commodities in the digital asset space. This has made Web3 entrepreneurs and companies face a lot of regulatory risk, which has led many of them to move their operations overseas. Because the Web3 community is anonymous, especially when it comes to starting a business, it is impossible to give exact numbers. But if you talk to Web3 users for a while, it becomes clear that they are not from the United States.

Still, owners and users (especially in GameFi) need to be careful. Grunfeld said, “I don’t see how U.S. regulators could go after a U.S. individual for gaming on an illegal site unless that individual is using that site for money laundering or other illegal activities involving other U.S. citizens.”

“If that doesn’t happen, the person who puts money in takes the risk,” he said. “People may often think that these platforms are governed by U.S. regulation when they are not. Then, the platform takes on all of the regulatory risk. It is the platform’s job to follow local and international laws, and if it opens accounts for people in the United States, it could get in risk with the U.S. Treasury.

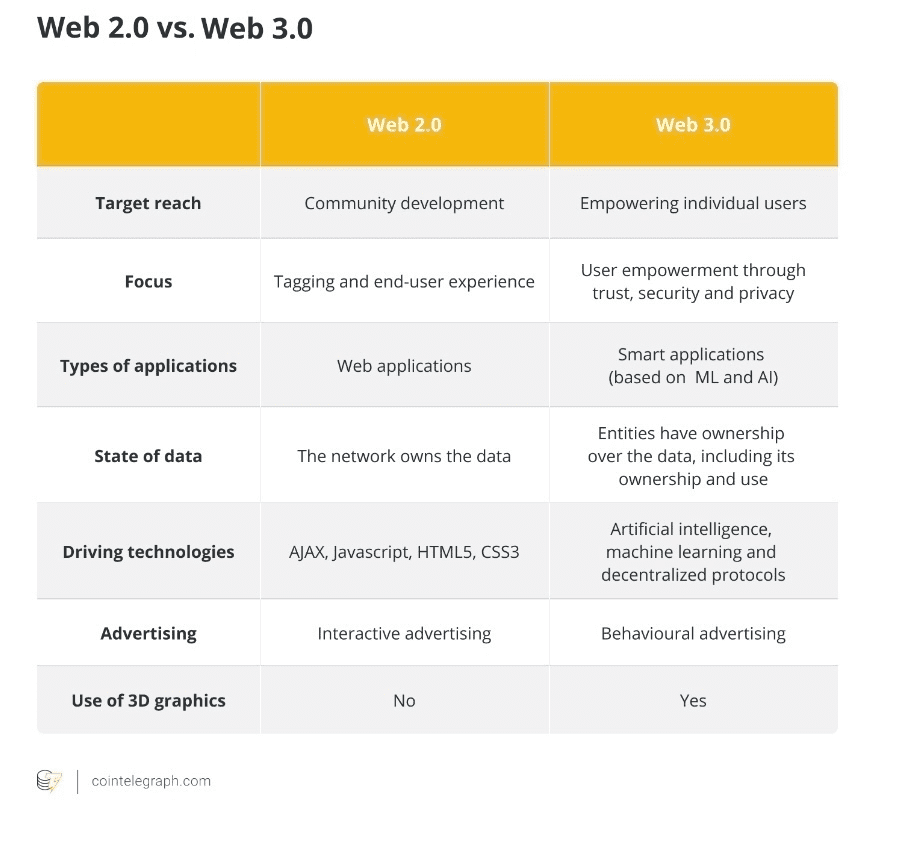

Web 2.0 & Web 3.0

Standards are a big part of how markets play. They make sure that at least a certain level of quality is met. The best standards are those that grow out of demand and cooperation in a community, where people realise that everyone will be better off if they all follow a set of best practises. The W3C standards, which cover all parts of application development, may be the best example of a common set of open-source and organic standards.

In particular, the W3C standards for verifiable credentials and decentralised IDs have been the main sources of coordination and adoption in global education. Organizations, from governments to large public companies, need technologies that work together and don’t lock them into specific vendors or systems, which could put them at unnecessary risk if, for example, one system goes down or a business fails. Without these kinds of standards, innovative technologies will stay one-of-a-kind and never reach a large number of people.

We are seeing how open-source standards in the use case of education give anyone in the world the opportunity to look at a technology and ensure sure it has been thoroughly tested for privacy, security, and interoperability. This makes it clear and easy for large institutional partners to bring new technologies to a lot of masses.

“Without a strong backbone based on standards, it would be impossible to teach Web3 to a large number of masses… The chairman of The Learning Economy Foundation, Chris Purifoy, said that all of the innovation in our industry would eventually lead to a jumbled mess of systems that don’t talk to each other or share information. This would be just like the old centralised systems.

The question for us in the cryptocurrency space is whether or not we can come up with a set of standards similar to the W3C standards for verifiable credentials in the market for education. These standards not only make sure that things work together, but they also set rules and best practises that make sure a minimum level of quality. That would make it easier for regulators to keep an eye on NFT and other crypto projects because the overall quality of projects would be higher and “rug pulls” would happen much less often.

There’s no easy way out of this, but both sides need to learn more about the other’s point of view. This will only happen when they meet in the middle.

Christos A. Makridis is the chief operating officer and chief technology officer for the Web3 multimedia startup Living Opera. He is also a teacher at Stanford University and Columbia Business School. He has a Ph.D. in both economics and management science from Stanford University.