Bitcoin [BTC]’s HODL story has been losing steam over the most recent couple of months. The market has moved for transient benefits and this has had a cost on Bitcoin’s exhibition. Particularly it’s capacity to arrive at medium to long-term targets.

Bitcoin’s cost activity neglected to hit its mid-term targets and has been consigned to the lower range over the most recent half year. This is in spite of its sharp markdown during that time and weighty gathering during the plunges. Its potential gain has been moderately restricted, trailed by more drawbacks.

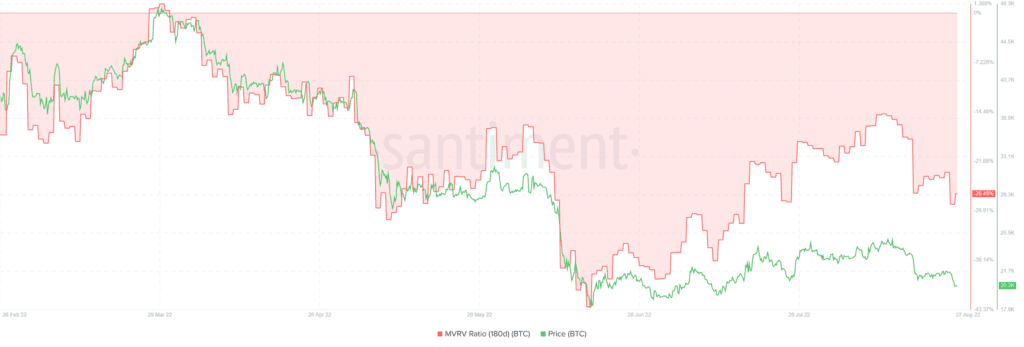

Long-term holders have thus been not able to stay in benefit. This result is shown by Bitcoin’s 180-day Market Value Realized Value (MVRV) proportion, which has a stayed in regrettable area throughout the previous half year.

Bitcoin’s half-year absolute supply in benefits is right now in its lower range. The drop during this period affirms that HODLers who purchased BTC before on are still out of cash. It likewise upholds the story of the transient benefit where investors that purchased all the more as of late close to June lows partook in certain benefits.

The normal story with regards to Bitcoin’s benefit is that momentary additions have been more ideal. This result consequently implies that any solid purchasing tension over the most recent couple of months was consigned to restricted potential gain.

Unexpected Benefits

Bitcoin’s ongoing quest for momentary productivity implies it has become simpler to anticipate sell tension and cost floors. For instance, the retest of 2017 highs has serious areas of strength for showing close to the $20,000 cost range. Bitcoin has delighted areas of strength for in after each plunge, and this could have added to the technique shift for transient open doors. This result additionally reflects Wyckoff gathering and conveyance.

Full-scale monetary variables have a weighty hand in the ongoing inclination for transient benefits. The crypto and items markets have been confronting strain from the hawkish position of controllers. The possibilities of a significant bullish recuperation in the present moment have thusly been watered down.

Numerous investors are as yet stacking up fully expecting long-term recuperation regardless of momentary benefit taking. Long-term hodlers are still minimizing risk in the market. Particularly now that the bear market is moving toward its last part. Bitcoin could likewise be close to its ongoing cycle’s floor cost since holding at lower costs will restrict its disadvantage.