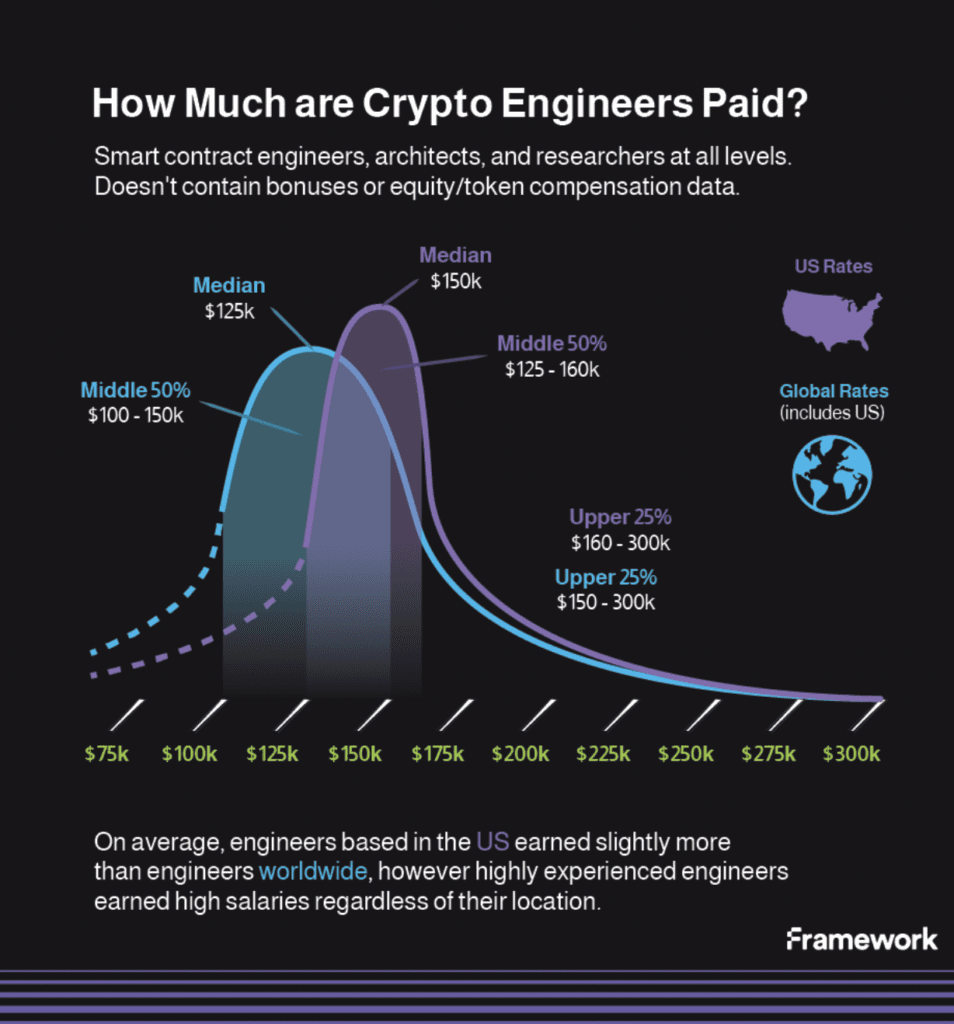

Does it make sense to quit your job and work in crypto? Framework, a crypto venture capital firm, has just released a new study that helps answer this question by offering at startup salaries and giving concrete information to anyone who wants to join the crypto gold rush.

The venture capital firm asked 18 companies in which it has investments how much money they make. Pay for both technical and non-technical salaries is well into the six-figure range, with one high-flying engineer making $300,000 in base pay. Founders can also expect to get between 1% and 10% of the total supply of tokens.

Daniel Mason, an operating partner at Framework Ventures and the person in charge of the survey, said, “There’s nothing like Glassdoor or Levels for Web3 right now.” He said that sharing this information helps “both founders and job seekers by making the ecosystem more open.”

In May, an anonymous survey was done with early-stage companies that had anywhere from two to eighty employees. Companies in Framework’s portfolio are mostly focused on Ethereum-based decentralized finance (DeFi) projects, infrastructure, and Web3 gaming. This includes lending protocol Aave, play-to-earn game Illuvium, and stablecoin project Fei.

The data shows the base salaries and allocations of equity and/or crypto tokens for four key groups: founders, executives (non-founder c-suite hires), engineers, and operators who are not engineers (sales, marketing, recruiting, etc.).

“Base salaries for Web2 and Web3 roles are similar, but the token upside is what makes the difference,” said Dan Eskow, founder of the crypto recruiting firm Up Top. “Even a small token allocation can be very valuable if the project becomes the next billion-dollar protocol.”

Framework’s Mason says that a bear market, which is still going on in crypto, is the best time for people who want to ride the next crypto rocket ship.

Mason said, “There are no guarantees when it comes to compensation packages, but I think it’s usually best to lock in terms when a project or company is valued lower.” “While FAANG stocks are down 30%–35% year to date, crypto is down much more, so I think it’s possible that those who join the right project now could see more upside than those who joined at the top of the last bull market.”

Founder compensation

Early-stage companies: $100,000 to $175,000 per year, with the top of the bell curve at $130,000 to $160,000.

$175K to $225K for later-stage businesses

Non-token equity: About 80% of it was owned by the founders in the early stages, but by later rounds, that had dropped to 20%-50%.

Token equity: Founding teams own between 8% and 12% of the token supply of tokens, while individual founders own between 2.5% and 7.5%, with 4%-6% being the most common. The single founder of an early-stage startup had the highest percentage of ownership, at 10%.

- In the early companies of a company, the founders usually pay themselves just enough to live a comfortable but basic life.

- The salaries of U.S.-based founders were higher and those of international founders were slightly lower, depending on location and cost of living.

- To motivate employees in decentralised networks (DAO), token ownership (rather than equity) is the way.

Non-founder executive compensation

Early-stage companies: $120K-$160K

Later-stage companies: $225K+

Non-token equity: 1%–4% of company equity in early-stage companies; 1%–2% of company equity in later-stage companies.

Token equity: 0.5%–1% of the maximum token supply at DAOs and protocols with a token at later-stage companies

- C-level hires in engineering and business development were often the highest-paid executives who weren’t the company’s founders.

- Many executive sales jobs have high variable pay in the form of bonuses that depend on how well the job is done.

- Floor pay was higher for executives who were based in the U.S.

Engineer compensation

Early-stage businesses: $120,000 to $160,000

Later-stage companies: $225K+

Non-token equity: 1%–4% of company equity in early-stage companies, and 1%–2% of company equity in later-stage companies.

Token equity: 0.5% to 1% of the maximum token supply at DAOs and protocols with a token at later-stage companies

- Non-founder C-level hires in engineering and business development were often the highest-paid executives.

- Many executive sales jobs have high variable pay in the form of bonuses based on how well the job is done.

- The floor pay for U.S.-based executives was higher.

Non-founder business operations compensation

Business development and partnerships: $60K to $120K for mid-level; $150K for senior-level

Marketing and communications: $80,000 to $100,000 for mid-level, $140,000 for senior-level

- $60K–$120K for mid-level; $150K for senior-level, which is usually only hired by later-stage companies.

- Operations, design, hiring, and managing the community: up to $130,000

- Token equity: project dependent